Federal Loans: Your Most Flexible College Funding Tool

Article submitted by Jordan Hersey, 3Rivers Youth & College Advisor

If you’ve met with our Youth & College Support Team before, then you’ve heard us preach about the FAFSA and the importance of it. Not only for potential grants, but also for federal loan eligibility. Loans are obviously not ideal, but sometimes necessary to fund the school you want to go to. If you’re going to take them out, it’s important to know the facts and why we believe federal options are a better fit for most overall than private loans.

Common myth: My parents make too much money, so I won’t qualify for any federal aid

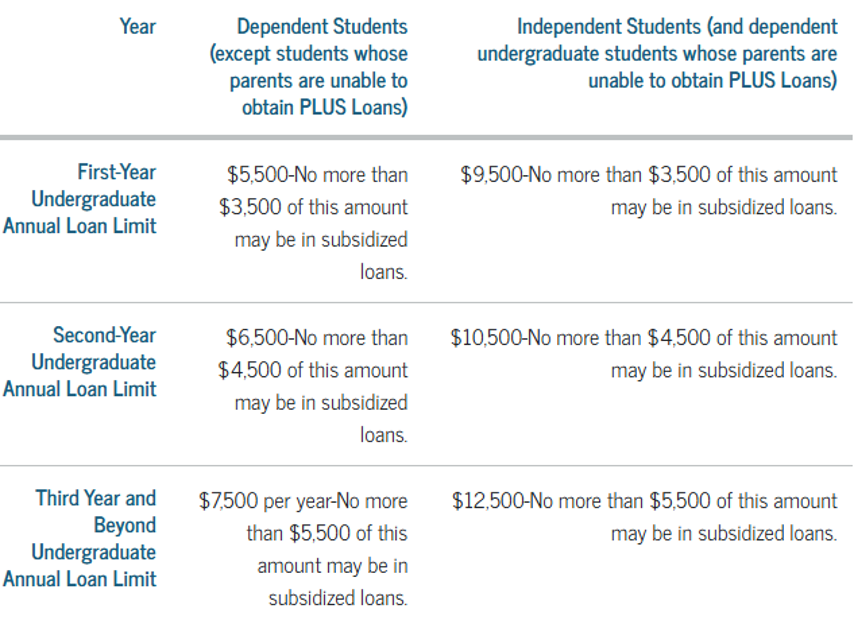

Now, you may be right in that you might not get any federal or state grants, but you will get offered the same amount of federal loans as every other student. Every single dependent and independent student get offered the following for undergrad:

You can find more information here, including what classifies an independent student.

There are several reasons that make federal loans a superior option to private loans. For one, there are potential loan forgiveness opportunities depending on what field you’re going into. Federal loans also come with access to income driven repayment plans to support you through times of hardship or crisis. And they don’t require a co-signer in order to get them, so that is not a hurdle or determent on eligibility if you don’t have parental/guardian support. And depending on income, you might get offered some “subsidized” loans, which do not accrue interest while you are in school.

For students living in the Northeast region of Indiana planning to live in this region after achieving your degree, we highly encourage you to check out the Questa Foundation and their forgivable loan programs, as well as the “traditional scholars program” for seniors in high school, and the “contemporary scholars program” for any students beyond that point—which offer no interest accrual, good rates, and loan forgiveness opportunities!

We’re always happy to discuss your loan options more in depth and explore the best mix of funding solutions for your needs and goals. Get in touch at 260.399.8265 or at college@trfcu.org to chat or schedule a meeting. We’re here to help!