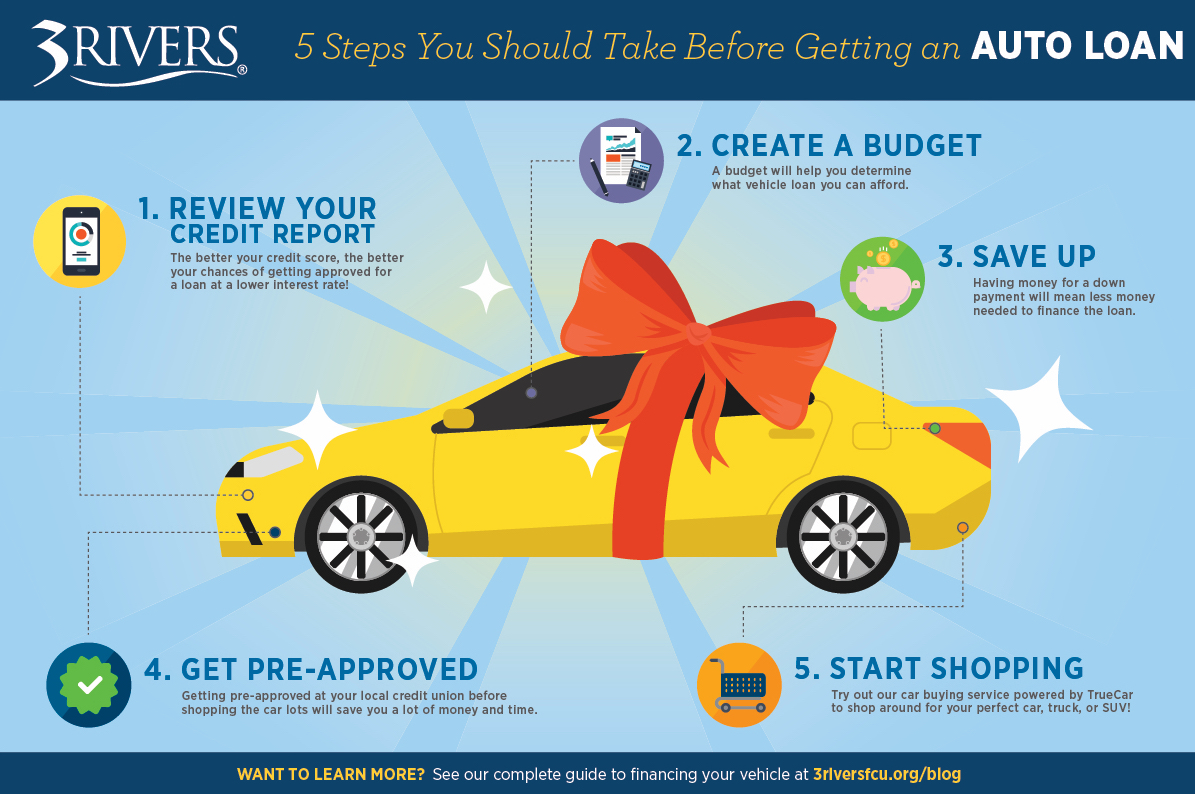

5 Steps You Should Take Before Getting an Auto Loan

Whether you’re planning to buy a new car, an old car, a third car, or your very first car, there are a few steps you’ll want to take before visiting the dealership.

Review Your Credit Report

Your financial institution will pull and review your credit report to determine your credit-worthiness, or how likely you are to pay an auto loan back on time. The better your credit score, the better your chances of getting approved for a loan at a lower interest rate. In general, it’s a good idea to check your report to make sure it’s in tip-top shape and that there are no suspicious activities reported on it once a year. We recommend getting a free copy of your report at annualcreditreport.com.

Create a Budget

Creating a budget, or updating your current budget, for all of your existing finances will help you to determine how much of a vehicle loan you can afford to add in – or whether you’d be better off paying down some of your existing debt before you take on more.

Save Up

If you’re not in a huge rush to get a new vehicle, it would benefit you to save up some money before taking out a loan. Having money for a down-payment will mean less money needed to finance the loan when the time comes. Additionally, you can plan to hang on to some of the money in your “vehicle fund,” for the additional costs that come with making this purchase - like insurance, title costs, maintenance, and more.

Get Pre-Approved

Getting pre-approved at your local credit union before shopping the car lots will save you a lot of time and money. Keep in mind that each time a lender pulls your credit report for approval, your credit score takes a small hit, so getting approved just once will keep those inquiries from adding up. Plus, credit unions typically offer lower rates and fees for vehicle loans than most other lenders.

Start Shopping

Now that you’ve checked your credit report, figured out how much vehicle you can afford, have saved up a little money, and gotten pre-approved, Once you’ve taken these steps, it’s time to start shopping!