The Cost of Fear: How Money Anxiety Spooks Your Decisions

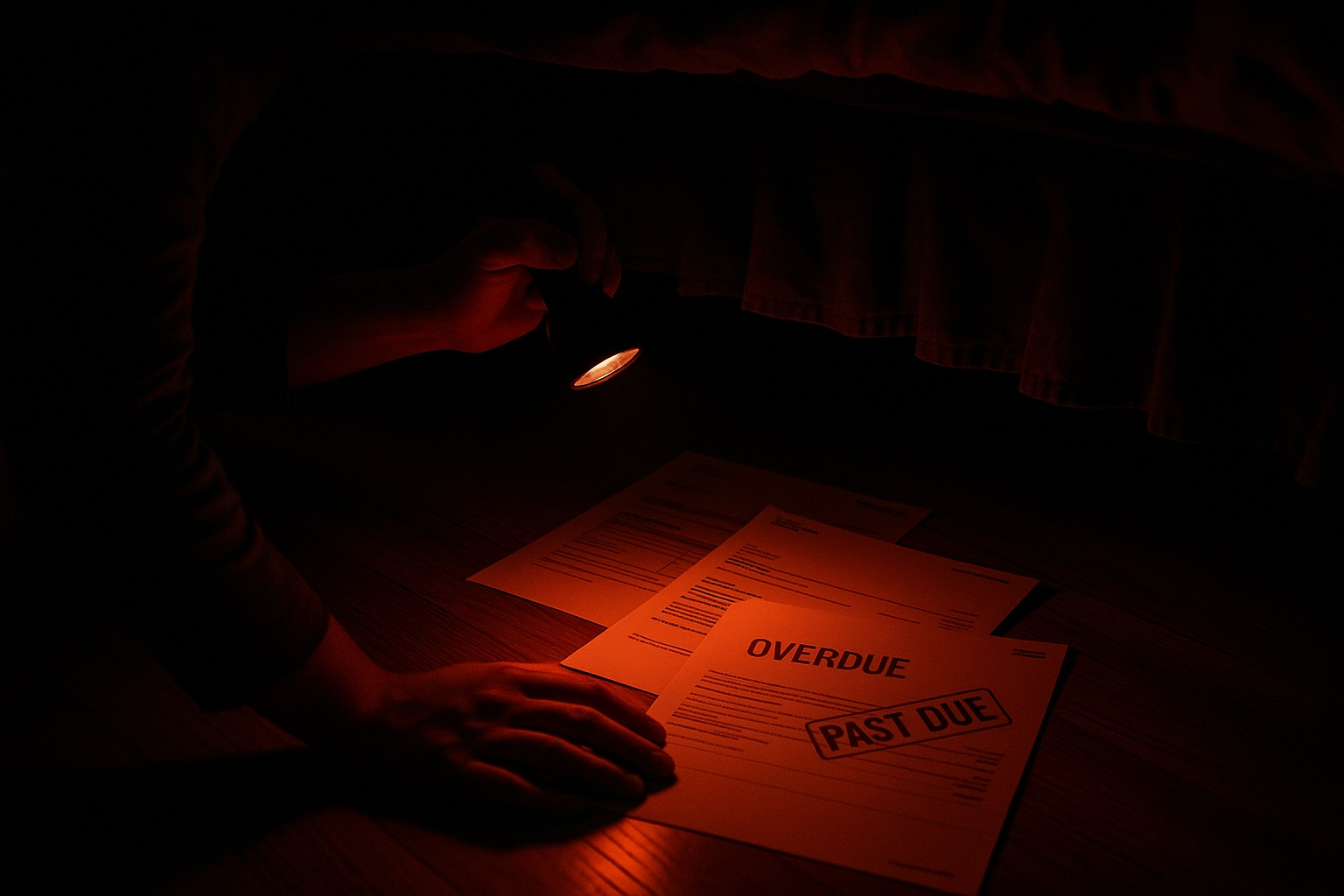

It’s that time of year for all things spooky... ghosts, goblins, and things that go bump in the night. But for many, the scariest thing lurking in the dark isn’t what's hiding in the rooms of a haunted house: it’s the numbers in their bank statements, the bills in the mail, or the notifications about their account balance.

When Fear Takes the Wheel

Money anxiety can creep up quietly, disguising itself as procrastination, avoidance, or even perfectionism. Maybe you hesitate to check your account after a busy week, or you delay opening a bill because you already know it’s more than you’d like to see. These moments might seem small, but they can snowball into bigger stress—and sometimes, costly mistakes.

Financial fear can trick you into making emotional decisions, like:

- Avoiding your budget altogether because “I’ll deal with it later.”

- Overspending to relieve stress or keep up appearances.

- Missing payments because it feels easier not to look.

- Avoiding long-term planning because the unknown feels overwhelming.

The problem? What we avoid tends to grow. And before long, the monster under the bed becomes harder to face.

Why We Fear Our Finances

Fear is a natural response. It’s our brain’s way of protecting us from perceived danger. But when it comes to money, that fear can come from deep-rooted experiences: past mistakes, financial instability growing up, or even messages we’ve absorbed from others about what “success” should look like.

Understanding where your fear comes from is the first step to taming it. Ask yourself:

- What specific financial task or situation makes me feel tense or uneasy?

- What’s the story I’m telling myself about it… and is it true?

- What would happen if I faced it head-on instead of avoiding it?

Sometimes, simply naming your fear takes away its power.

Turning on the Lights

The best way to handle financial fear is the same way you’d handle a spooky shadow: shine a light on it. Here are a few practical ways to start:

- Open your “scary” statements. You can’t fix what you don’t see. Even if it’s uncomfortable, knowing where you stand puts you back in control.

- Start small. Pick one thing you’ve been avoiding—like checking your credit score or setting a savings goal—and do that first.

- Build habits, not hurdles. Schedule time each week to review your accounts, even for five minutes. Routine makes it less intimidating.

- Talk about it. Whether with a trusted friend, a team member at 3Rivers, or a financial coach, sharing your concerns helps you gain perspective and solutions.

From Fright to Empowerment

Fear loses its power when faced with action. The truth is: your finances aren’t out to haunt you; they’re waiting for you to take charge and write a new story. Each time you log in, review, or make a mindful decision, you’re reminding yourself that you hold the flashlight.

So, this spooky season, let’s make a pact: no more ghosting your goals, no more hiding from your balance, and no more letting fear steer the way. Your financial future isn’t something to dread—it’s something to conquer with confidence.

Want a financial ghostbusting partner to join you? Sign us up! Let’s review your budget, talk through goals, and explore options for getting ahead. Schedule a time to talk at 3riversfcu.org/schedule.