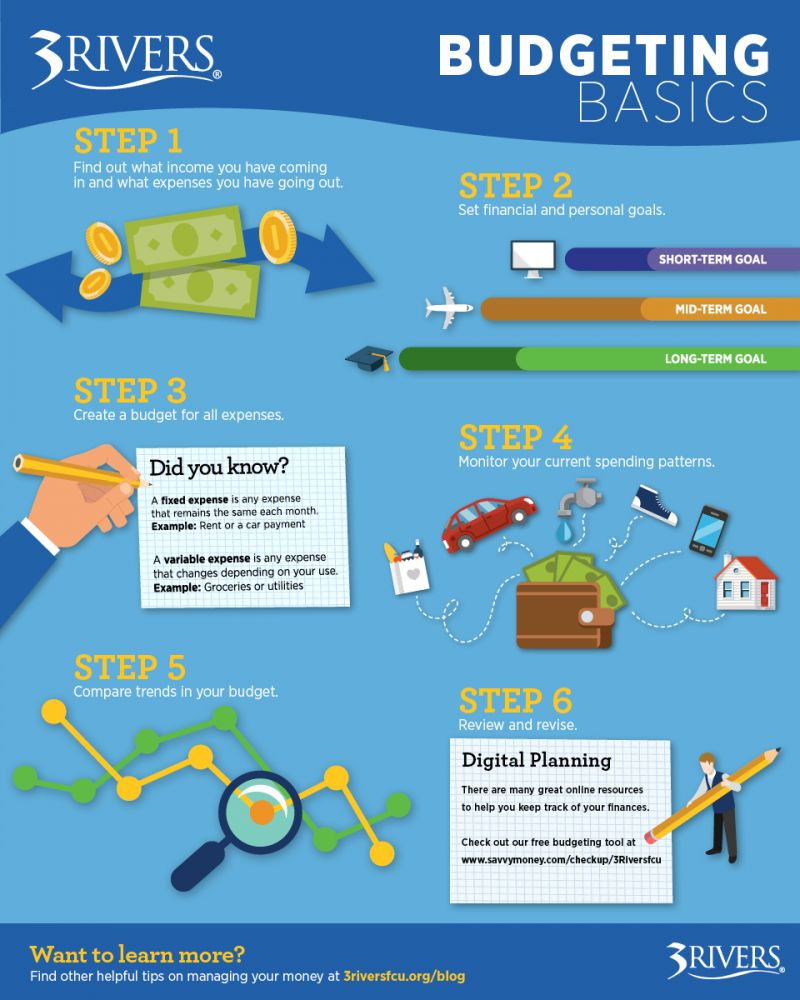

Personal Finance 101: Budgeting Basics

A detailed budget can help us achieve our financial goals and develop a plan on how to get there. 3Rivers Lending Administrator, Chris Mulkey, further explains the six basic steps of budgeting in the video below!

Step #1: Find out what income you have coming in and what expenses you have going out.

Be sure to include all income - wages, salary, tips, dividends, alimony, child support, and so on. Also do your best to include all expenses - even down to your weekday morning coffee costs and money spent on eating out, entertainment, parking, and more.

Step #2: Set financial and personal goals.

- Short-term goals: 1-4 weeks period. Example: Saving for a new piece of furniture.

- Mid-term goals: 2-12 months period. Example: Saving for a vacation.

- Long-term goals: Over one year period. Example: Saving for your child's college education.

Step #3: Create a budget for all expenses.

Break down into fixed expenses (which are set every month, like rent or a car payment) and variable expenses (can change every month, like groceries or utility bills.) | To learn more about fixed expenses and variable expenses, click here.

Step #4: Monitor your current spending patterns.

Jot down what you notice over the course of the first few weeks. Consider the following:

- Where does your money go?

- What are some expenses?

- What's included in your monthly payments, and what's the most important?

- Are you spending on wants or needs?

Step #5: Compare trends in your budget.

Compare the budget you set for yourself to how you've actually spent your money. Consider the following:

- Was your budget realistic?

- Where did you overspend?

- Where did you come in under budget?

- Did you aim too high or too low in some categories?

Step #6: Review and revise.

Take what you've discovered in Step #4 and Step #5 and list the patterns and trends in separate columns to better visualize and compare the two. From there, you can adjust your budget accordingly.

Remember, a budget is fluid until you identify the correct expense amounts. Ultimately, your goal is to adjust your spending to your budget, NOT your budget to your spending!

Want to learn more? Give our posts on Budgeting 101, Free Budgeting Tools + Printables, and How to Save on a Tight Budget a read!