Making Sense of Your Annual Escrow Analysis

This article was contributed by our Mortgage Servicing Team.

If you have a mortgage—or have done some research—you’ve likely come across the term escrow. Escrow is a separate account used to hold funds that will be used to pay certain bills related to your property, such as homeowner’s insurance and property taxes. These payments, known as disbursements, are made on your behalf when they come due.

Each year, we perform an escrow analysis to ensure that we’re collecting the correct amount to cover these disbursements. Depending on changes in insurance premiums or property taxes, your mortgage payment may increase or decrease as a result. If you have a mortgage with 3Rivers, you should be receiving your escrow analysis soon (if you haven’t already)!

Let’s break down how to make sense of your escrow analysis letter:

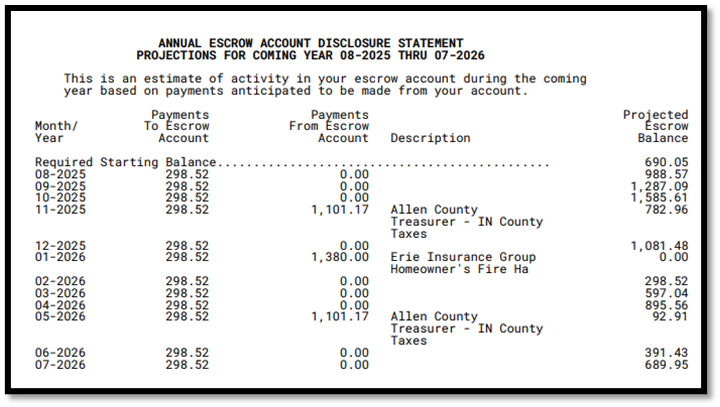

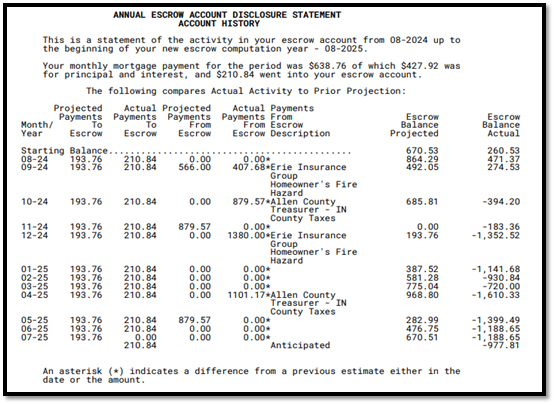

*This is an example and not your actual statement. This is for demonstration purposes only.

1. Annual Escrow Account Disclosure Statement – Projections for the Coming Year

This section outlines what we expect to pay on your behalf over the next year. These projections are based on last year’s actual payments, since we won’t know the exact amounts until the new bills are issued.

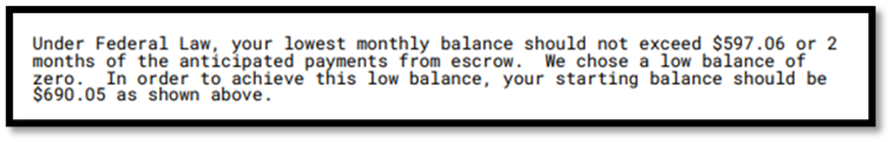

2. Starting Balance Requirement

This shows the minimum starting balance needed in your escrow account to help ensure the account does not fall below zero.

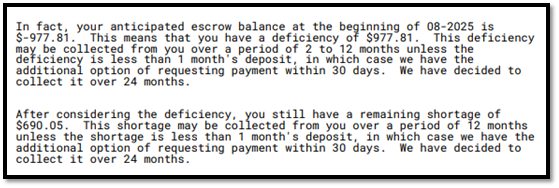

3. Calculation of Current Escrow Status

This section details the current status of your escrow account. It may include one or more of the following:

- Deficiency: This means your escrow currently has a negative balance.

- If there is a deficiency, we may spread the repayment over 12 or 24 months.

- Shortage: This is the amount your account is projected to be short in the coming year, meaning it could fall below zero.

- If there’s a shortage, we may also spread the additional required amount over 12 or 24 months.

- Surplus: If you've paid more than necessary, or if your disbursements decreased, you may have excess funds in your escrow.

- If the surplus is more than $50, we’ll send you a refund check for the overage.

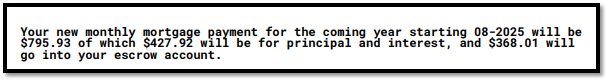

4. New Monthly Payment Details

This section provides the breakdown of your updated monthly mortgage payment, including how much goes toward principal and interest, and how much goes into escrow.

5. Annual Escrow Account Disclosure Statement (Account History)

This portion gives a summary of all transactions over the past year, including what was paid into and out of your escrow account.

If you notice any discrepancies, please contact us right away!

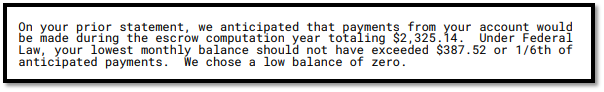

6. Minimum Escrow Balance

Sometimes referred to as the escrow "cushion," this reserve is maintained in case any bills are higher than expected. 3Rivers aims to keep this as low as possible—we don’t want to hold more of your money than necessary—so the goal is for your account to reach a $0 balance at some point during the year.

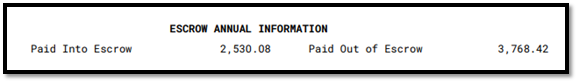

7. Escrow Annual Summary

A simplified comparison of how much was paid into escrow versus how much was paid out over the year.

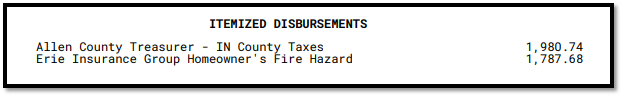

8. Disbursements

This section lists the total annual amounts paid out for each of your escrowed items, such as property taxes and insurance.

We know escrow analysis statements can feel a bit overwhelming, but we hope this guide helps clarify what you’re seeing and why it matters. Your escrow account plays a key role in managing important home-related expenses, and our goal is to make that process as smooth and transparent as possible.

If you have any questions about your analysis or need help understanding your escrow account, our Mortgage Servicing Team is here for you. Please don’t hesitate to reach out at 260.310.8822—we’re happy to assist!