Money Monday: An Overview of 529 Plans

You might not have college on the brain if your child is only a few months or years old, but it's never too early to start thinking about paying for college. Start saving now and you'll lessen the financial stress and scrambling that could come when your son or daughter excitedly rips open an acceptance letter to their, very expensive, college of choice.

.jpg?sfvrsn=8a15e8a1_0)

Easier said than done? We know it might seem impossible to save any more than you already are, especially when you’re still paying off your own student loan debt. But you do have options that can help – like a 529 Plan.

529 Plans

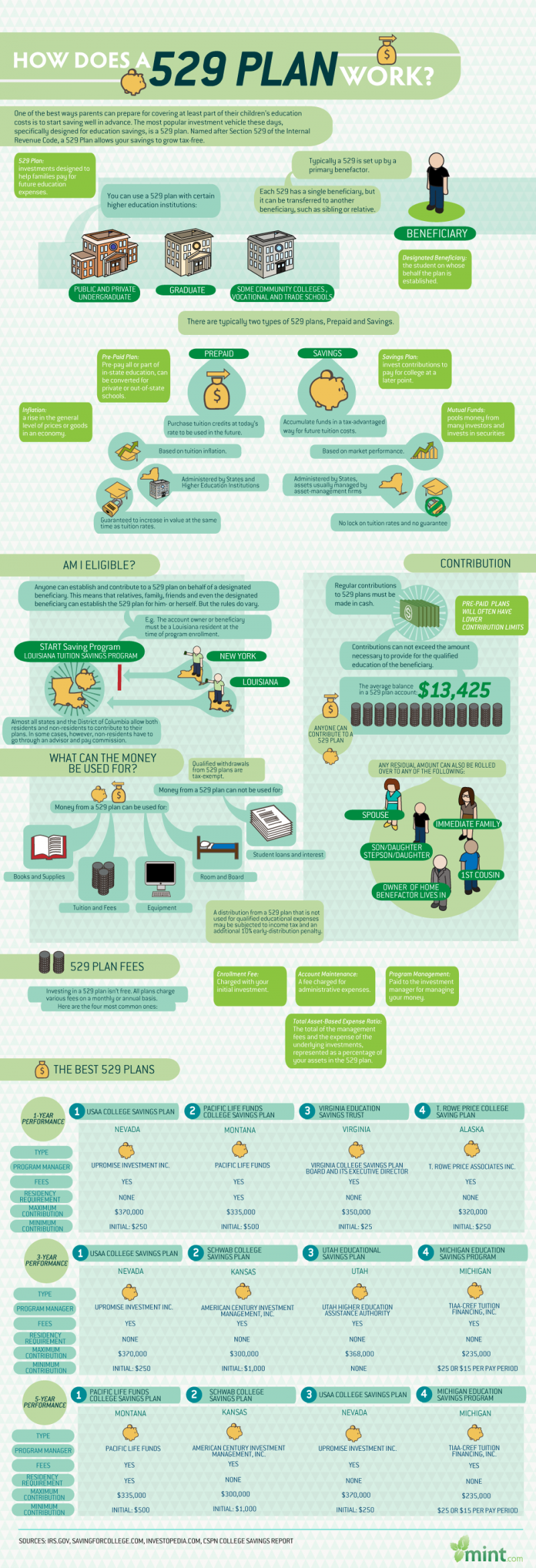

529 Plans are savings plans offered by institutions that offer perks to help families save for future higher education costs. They’re named after Section 529 of the Internal Revenue Code – created in 1996 to offer these types of savings plans. Anyone can open and contribute to a 529 plan for a future student – parents, grandparents, aunts, uncles, and so on. Should your student decide to cross state lines for school, he or she can still utilize the money in a 529 plan.

The Perks

- Federal Tax Benefits: Plan participants can expect tax breaks (the money goes into the account untaxed, like a 401K) so long as the plan satisfies a few basic requirements, so that your investments grow more quickly than a normal savings account.

- State Tax Benefits: Some states also offer tax incentives to investors (upfront deduction for your contributions or income exemption when it comes to withdrawals.) See what your state offers here.

- You’re in Control: As the donor, you’re in total control of the account. With a few exceptions, the beneficiary has no rights to the funds – you call the shots.

- Low Maintenance: Once you sign up for the plan you want, you make a contribution – or to make things even easier, sign up for automatic deposits – and breathe easy. Plan assets are professionally managed by the state treasurer’s office or an outside investment company.

- Simplified Tax Reporting: Until you make withdrawals, you won't receive a Form 1099 to report taxable or nontaxable earnings.

- Flexibility: If you decide to move your investment, you can rollover the funds into a new 529 savings plan option. Keep in mind, every 529 plan has different rules, so make sure you’ve investigated the terms and conditions.

- Substantial Deposits Allowed: Anyone and everyone is eligible to take advantage of a 529 plan. Typically, there are not age or income restrictions. If you think you might head back to school in the future, you can even set one up for yourself!

How 3Rivers Can Help

Sound like you could benefit from a 529 Plan? 3Rivers can help! Our financial advisors are more than happy to meet with you and discuss saving for college more in-depth, and help you determine the right savings option for you and your family. Get in touch with us anytime to set up an appointment at 260.487.3348.

Information via SavingforCollege.com