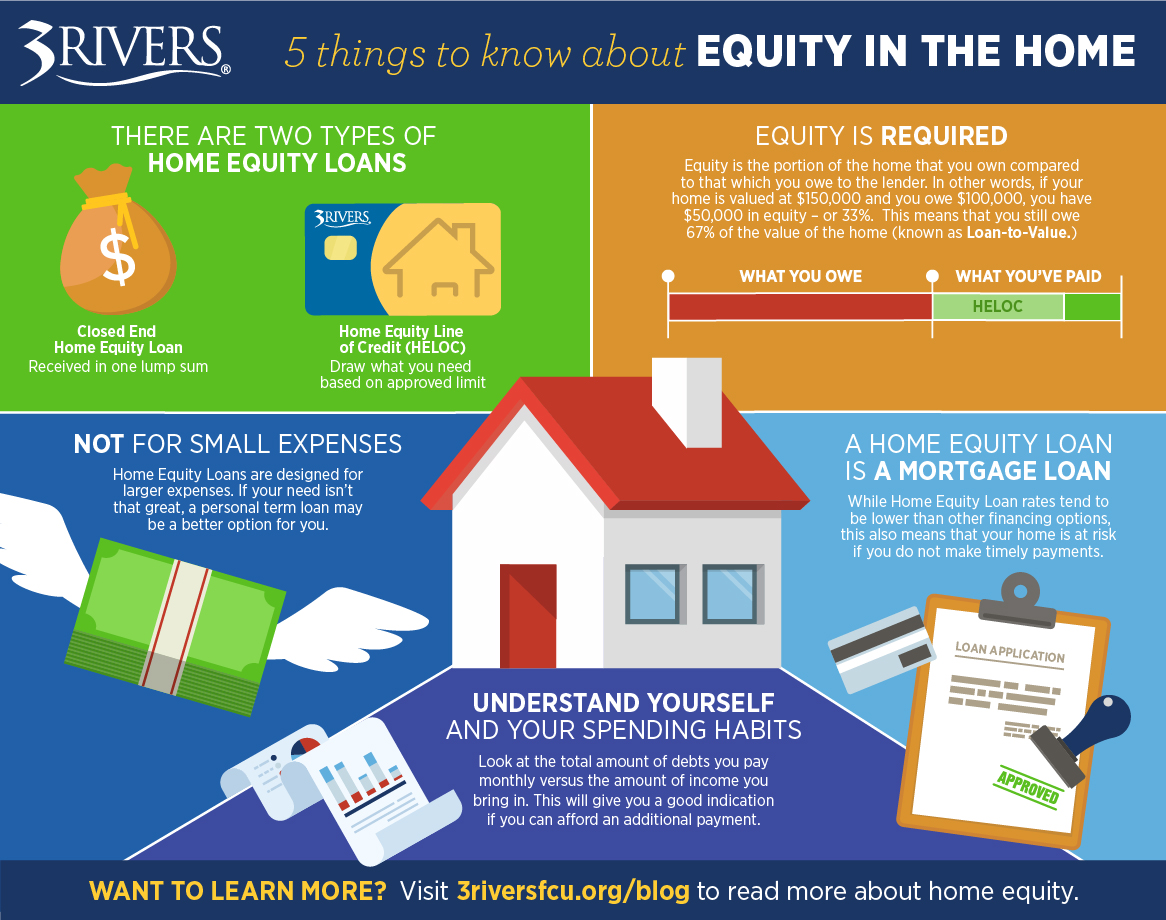

5 Things to Know About Equity in the Home

Thinking about taking out a home equity loan? Here are five things you should know before moving forward.

There are Two Types of Home Equity Loans

It’s important to consider your financial needs, and when and how you’ll be using the funds, to determine which option best suits you.

- Closed-End Home Equity Loan: This is your best option if you’re looking to obtain a lump-sum payment. The uses for this loan are vast. You can use the funds from a closed-end loan to replace the roof on your home, finance a home improvement project, assist with debt consolidation, pay off a major unexpected expense, and so on. This loan type offers a fixed rate, which means the rate will stay the same while you pay the loan back over a pre-determined amount of time. In most cases, you can expect a term of 10 to 15 years to repay the loan, depending on the amount you borrow.

- Home Equity Line of Credit (HELOC): This option provides you a greater level of flexibility when it comes to using the funds, since it's a revolving line of credit (similar to a credit card). HELOCs are often used for financing an ongoing home-improvement project, paying for higher education, or paying for recurring seasonal expenses, since they allow you to borrow the funds as the need arises. As you pay back what you've used, the line of credit is replenished, and you'll only pay interest on the amount you've borrowed. Unlike closed-end home equity loans, the interest rates on HELOCs are adjustable (not fixed), which means the interest rate may change over the course of the loan. The draw period (the allotted time to borrow on the loan) is up to 15 years (at 3Rivers), and HELOCs are amortized over 15 years as well.

Both options have closing costs, though they are significantly lower than what you’ll find with a first mortgage loan product.

See Our Home Equity Loan Options

Equity is Required

Equity is the portion of the home that you own compared to that which you owe to the lender. In other words, if your home is valued at $150,000 and you owe $100,000, you have $50,000 in equity (or 33%). This means that you still owe 67% of the value of the home (known as loan-to-value or LTV).

- Typically, 3Rivers likes to see 20% or more in equity (80% LTV) in your home after the home equity loan is complete.

- In this scenario, you could expect to receive 13% of the value of your home (or $19,500). This would bring the total amount owed to $119,500, which is approximately 80% of the value.

- 3Rivers does offer home equity loans up to 90% LTV. So using the same example, you could borrow up to $135,000 total (first mortgage balance plus the home equity loan balance). This will typically carry a higher interest rate compared to the 80% LTV loan because less equity is available.

Not for Small Expenses

Home equity loans are designed for larger expenses. Typically, a home equity loan will carry a minimum loan amount of $10,000. So, if you don't need that much money, you may want to opt for another option, such as a personal term loan. Another consideration is to take out a $10,000 HELOC and only borrow what you need.

It's important to remember, however, that even if you only intend to use a portion of the line, you will need to have 20% equity in your home above and beyond the total amount of the line of credit limit amount.

A Home Equity Loan is a Mortgage Loan

Don’t forget, these options are considered a type of mortgage loan. They're classified and treated as a loan with interest in the property that is securing the loan from the lender. As with all mortgage loans, there are pluses and minuses for the borrower.

- One downside to a home equity loan is that the loan is secured by the home. This means that your home is at risk if you don't make timely payments to fulfill your obligation. The potential consequences include late fees, foreclosure, and a possible judgment. It's important to treat a home equity loan with the same importance and attention as you would a first mortgage loan.

- Because a home equity loan is similar to a first mortgage loan, it also has its advantages. For instance, the rates tend to be lower than rates found on unsecured loan options such as lines of credit, personal term loans, and credit cards. Also, the interest paid on a home equity loan is typically tax-deductible. As with any tax situation, we advise that you consult a tax advisor to give clear guidance on the overall benefits of this feature.

Understand Yourself and Your Spending Habits

It's important to identify your overall financial picture, including your spending habits, before entering into an agreement for any loan, especially one where your home is the collateral!

Take a look at the total amount of debts you pay out each month versus the amount of income you bring in. This will give you a good indication of whether you're able to comfortably afford an additional payment.

Budgeting for payment on a closed-end home equity loan is simple. You'll receive the payment amount you'll make over a specific period of time. For a HELOC, you'll want to budget for 1.5% of the outstanding balance to be paid out each month. This may change depending on the amount actually borrowed as discussed earlier.

Home equity loans are just one of many options that exist to help you with your financial needs and goals. Our best advice is to make sure you fully research and understand all of your options to determine your best course of action. Our Mortgage Team is always happy to review and discuss your options to ensure you make the best decision for your finances now and in the long term!

See Our Home Equity Loan Options Get in Touch with Our Mortgage Team